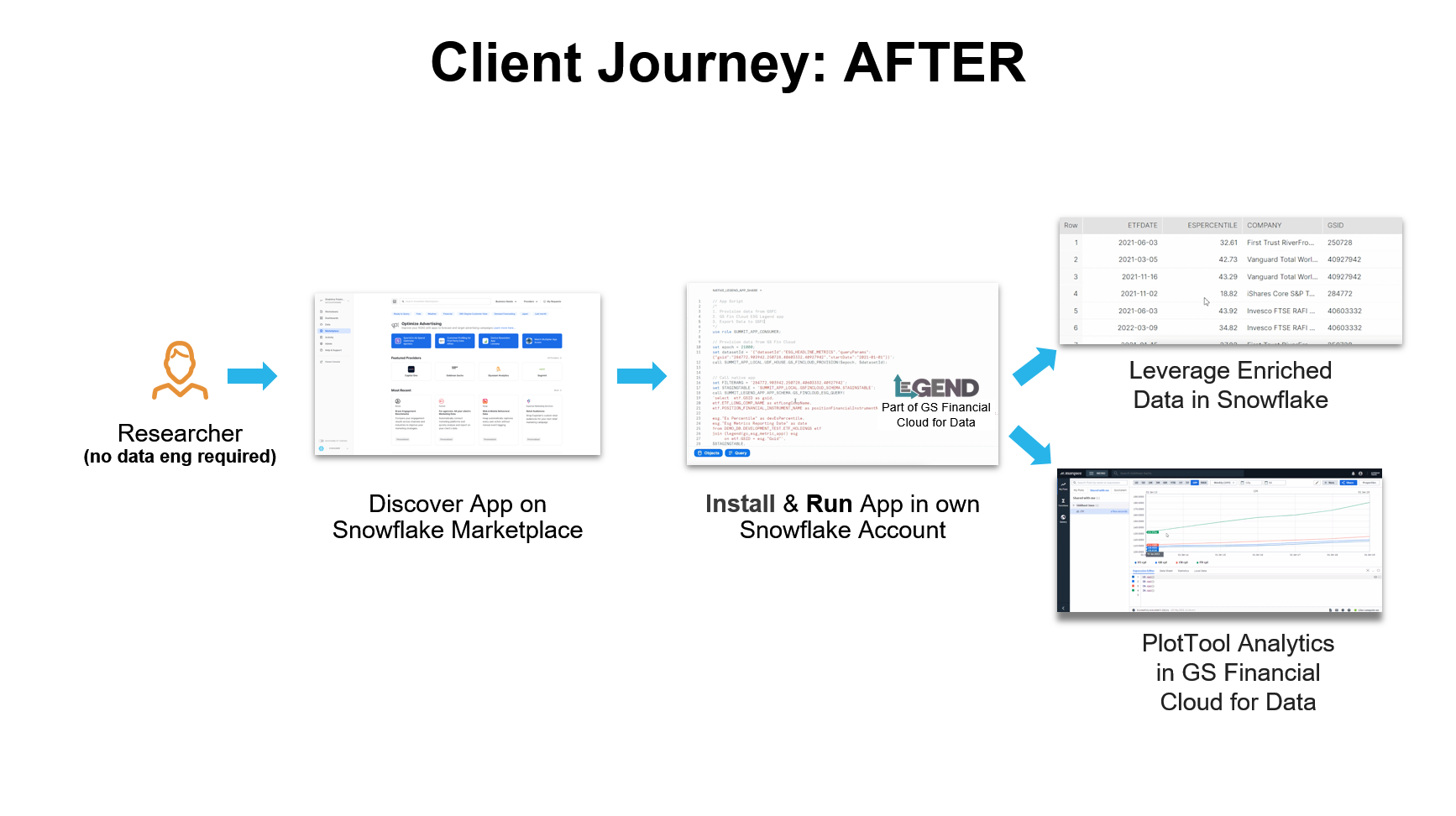

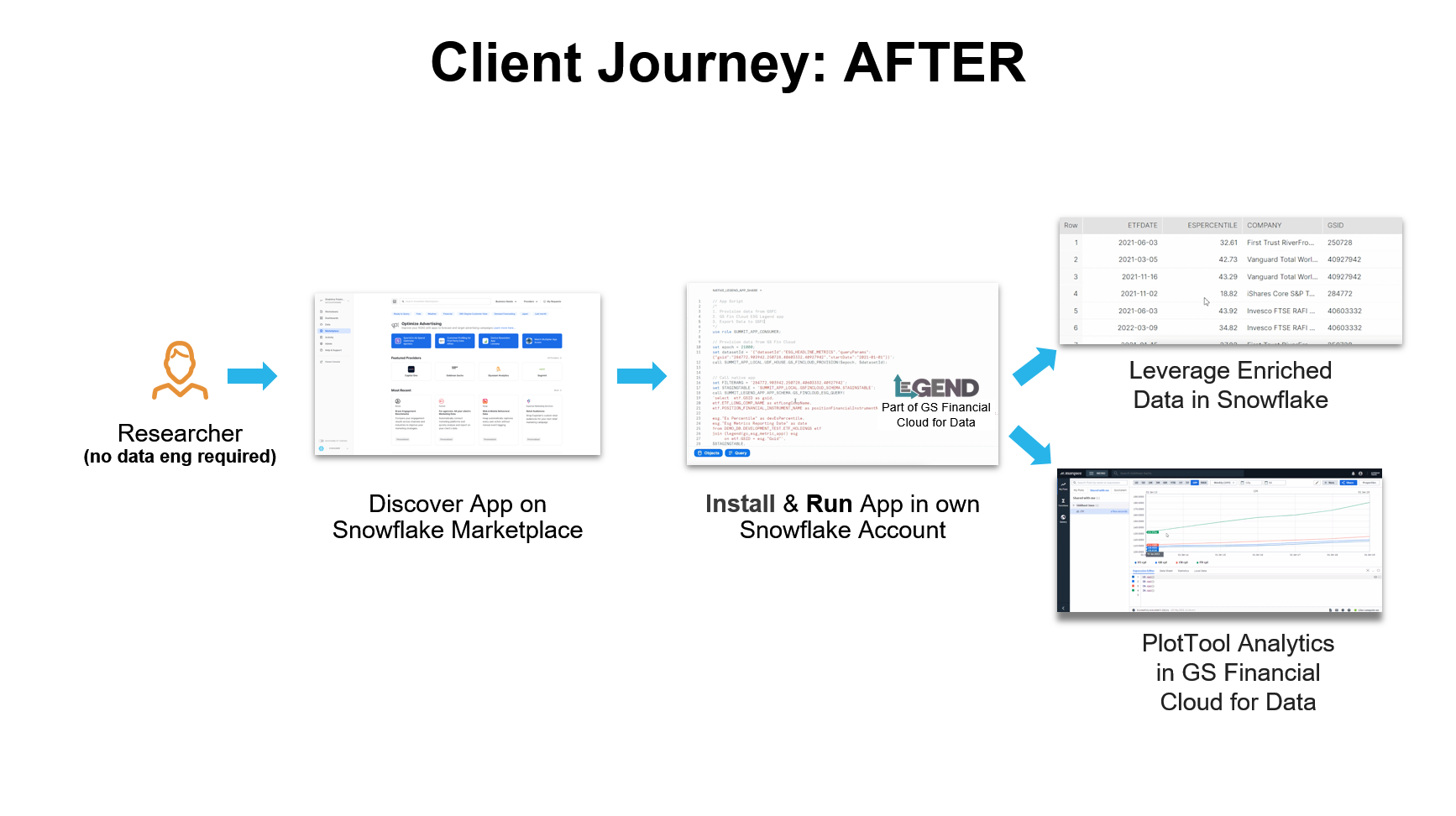

Last month Goldman Sachs' Chief Data Officer, Neema Raphael gave a keynote presentation at the Snowflake Summit Conference. Neema's talk focused on combining Goldman Sachs Financial Cloud for Data with our open sourced data platform Legend powering a Snowflake application to generate transformational business insights for our clients, business partners and engineers. What used to be a painful, multi-week process requiring support from engineering has become a self-serve, intuitive experience that takes a couple of days. Further, the application offers the best of all worlds: research velocity, performance, and governance. The Legend data platform uses Snowflake native app functionality to provide the governance and benefits of API style application development with the native performance of database joins and predicate pushdown. Watch the replay of the talk from the Snowflake Summit.

How engineers at Goldman Sachs and Snowflake partnered to unlock native Snowflake performance on top of Legend APIs

Goldman Sachs's data strategy is tied directly to Legend and the firm's Financial Cloud for Data. Our latest offering gives our clients access to curated GS data and provides a client-owned AWS runtime to power the behind-the-scenes data movement. We are also users of Snowflake for relational data warehousing and data engineering.

The idea to combine our capabilities was born from a simple conversation that happened in April 2022... Abhishek relates how the idea came about

Running our vendor data engineering team I have personally seen the time and energy required to set up teams with access to new datasets. It is a frustrating process - for both business users and engineers;

At a recent Snowflake event, I learned about Native Apps, a marketplace of new capabilities they built on top of secure data sharing. Following the event, my manager stopped by my desk to learn more about these features and brainstormed how Snowflake Native Apps could potentially solve a critical and long-standing issue for our users

This conversation quickly led to an “ah ha!” moment: if we can combine Legend with the Snowflake Native App capabilities, we can unlock the full performance of Snowflake while still providing logical separation of client, vendor, and Goldman Sachs data.

This new idea presented a great opportunity to work with internal researchers to understand the impact we could achieve. And the impact really was phenomenal - our research partners could setup new datasets in days instead of months. They could do this in a fully self-serve model while adhering to data governance standards. And our engineering team didn't have to support our business teams every single time they wanted new datasets or insights. A win-win for everyone!

But our ambitions didn't end there. Once we unlocked the foundational set of capabilities from this new solution, we wanted to push the boundaries of this innovation. The next step was for us to identify a real-world use case that could scale this not just internally at GS, but to external clients of the firm. We decided to leverage data from the newly launched Goldman Sachs Financial Cloud for Data to make the experience of sharing insights with our clients even more seamless. Adding more functionality within our existing application suite is a powerful value proposition for our clients. We are excited to go-to-market with this service once Snowflake Native Apps are publicly available (expected end of this year).

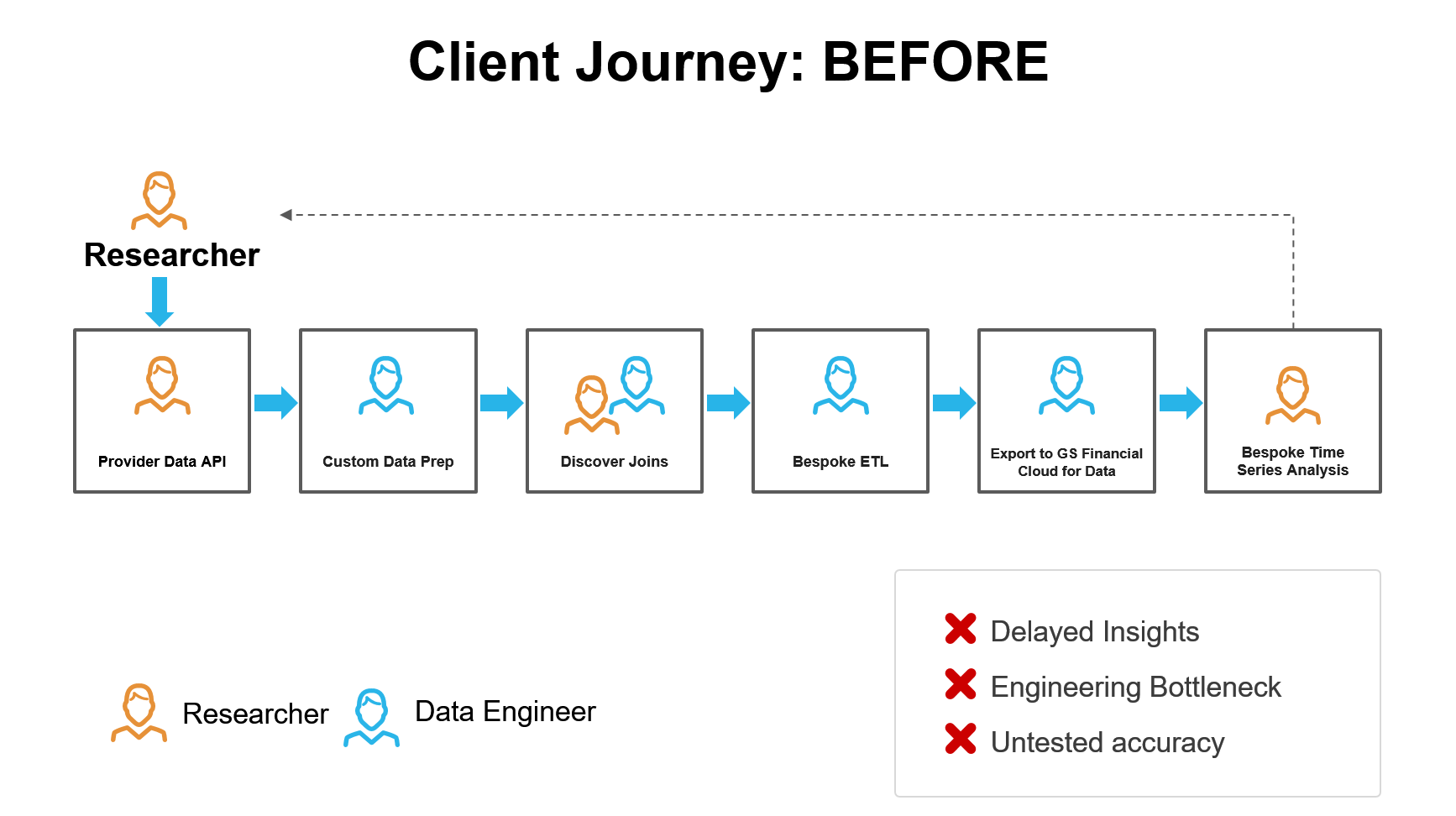

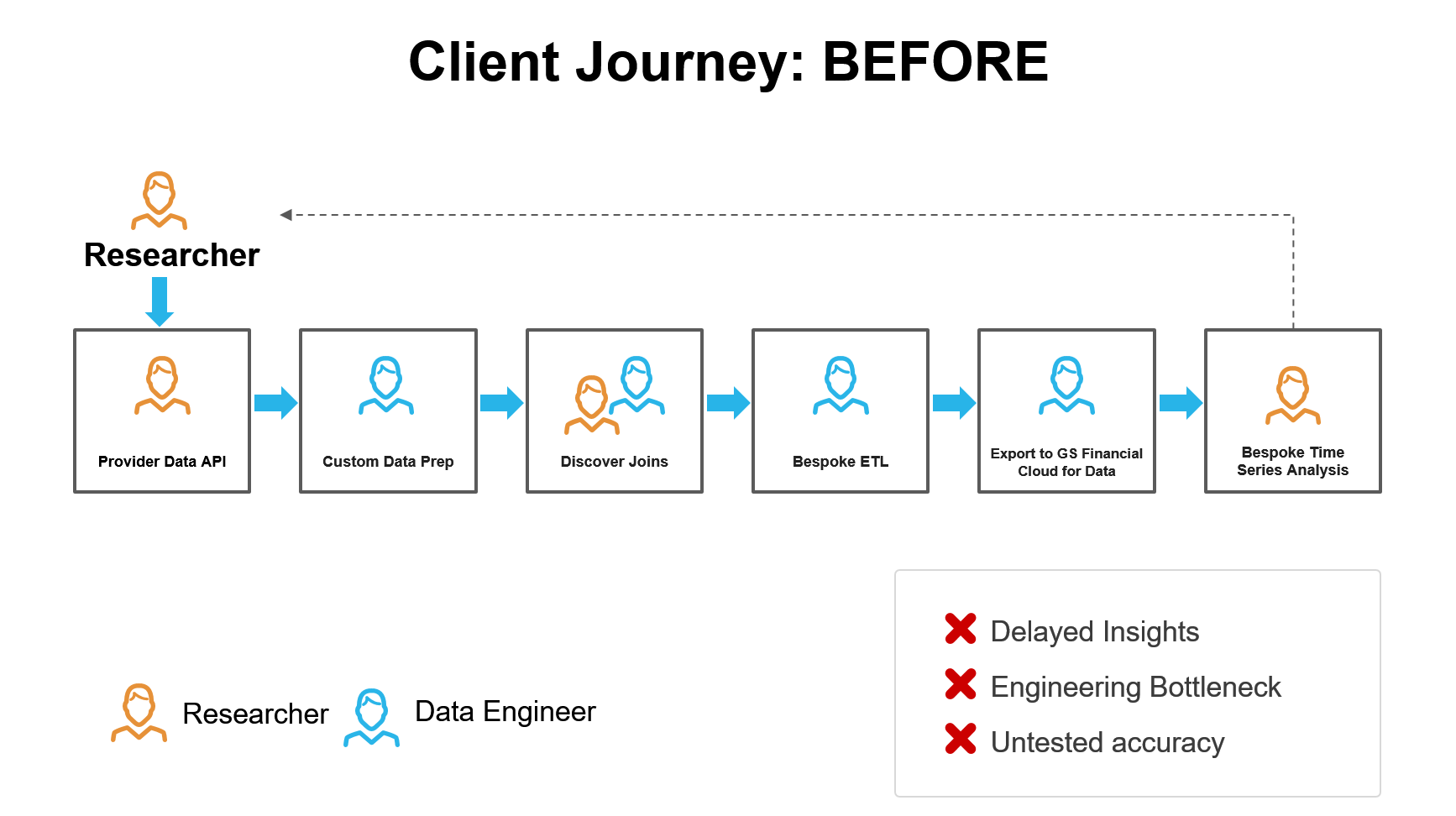

Our problem statement:

A researcher at an institutional investor client who wants to access new datasets from various external sources has to work with a data engineer to complete a multi-step time consuming process. They need to spend a significant amount of time figuring out how their internal data stitches together with third party data across multiple ecosystems. It’s also hard on the engineering side to understand the intent of Quants/Researchers as they run into complex extract, transform and load (ETL) problems with multi hop operations yielding lack of ownership and performance issues. After this is all in production, the researcher still does not get lineage.

Our mission:

Allow business users to pull together all the data in need using an intuitive, self-service experience that is highly performant, secure and scalable.

Our solution:

Our underlying technology is based on Legend, GS’s open source contribution to FINOS. Legend is a single platform for data model driven and insights generation. It is platform agnostic and can transpile model queries to SQL with full predicate pushdown. We have contributed a Snowflake native app that has been supercharged with capabilities from Legend (e.g., by transforming APIs to SQL, ensuring native database performance and GS specific data models are still being enforced). This gives users a simple process to get the data they need to generate insights.

- Get access rights to the new data in the Goldman Sachs Financial Cloud for Data and to the new Legend native app

- Download the Legend based native app from the snowflake marketplace and join their new datasets

- Upload the new data to the Goldman Sachs Financial Cloud for Data – their preferred solution for plotting graphs and generating insights

Here’s the impact:

This new app not only allows us to share relevant datasets with our clients but also using the same paradigm clients can share data internally with encapsulation and central integration / control point. Engineering teams no longer need to support business partners with the tedious work of creating and supporting custom onboarding data processes. They can instead focus on higher value tasks such as enabling connectivity across datasets through data models and easy tools to graduate from experimentation phase to production.

Internally, we are partnering with researchers in a business of Goldman Sachs that has been #1 ranked by our clients multiple years in a row. Our Vendor data acquisition engineering team can now bring their data discovery timeline from months to days.

And we do this while making our technology more performant and maintaining our standards around data governance and security.

By constantly thinking about new and innovative ways to extract the best out of Goldman native technologies and our partners like Snowflake, we are on track to making data consumption, sharing and analysis lightning fast, highly accurate and enormously simple.

See https://www.gs.com/disclaimer/global_email for important risk disclosures, conflicts of interest, and other terms and conditions relating to this blog and your reliance on information contained in it.

Solutions

Curated Data Security MasterData AnalyticsPlotTool ProPortfolio AnalyticsGS QuantTransaction BankingGS DAP®Liquidity Investing¹ Real-time data can be impacted by planned system maintenance, connectivity or availability issues stemming from related third-party service providers, or other intermittent or unplanned technology issues.

Transaction Banking services are offered by Goldman Sachs Bank USA ("GS Bank") and its affiliates. GS Bank is a New York State chartered bank, a member of the Federal Reserve System and a Member FDIC. For additional information, please see Bank Regulatory Information.

² Source: Goldman Sachs Asset Management, as of March 31, 2025.

Mosaic is a service mark of Goldman Sachs & Co. LLC. This service is made available in the United States by Goldman Sachs & Co. LLC and outside of the United States by Goldman Sachs International, or its local affiliates in accordance with applicable law and regulations. Goldman Sachs International and Goldman Sachs & Co. LLC are the distributors of the Goldman Sachs Funds. Depending upon the jurisdiction in which you are located, transactions in non-Goldman Sachs money market funds are affected by either Goldman Sachs & Co. LLC, a member of FINRA, SIPC and NYSE, or Goldman Sachs International. For additional information contact your Goldman Sachs representative. Goldman Sachs & Co. LLC, Goldman Sachs International, Goldman Sachs Liquidity Solutions, Goldman Sachs Asset Management, L.P., and the Goldman Sachs funds available through Goldman Sachs Liquidity Solutions and other affiliated entities, are under the common control of the Goldman Sachs Group, Inc.

Goldman Sachs & Co. LLC is a registered U.S. broker-dealer and futures commission merchant, and is subject to regulatory capital requirements including those imposed by the SEC, the U.S. Commodity Futures Trading Commission (CFTC), the Chicago Mercantile Exchange, the Financial Industry Regulatory Authority, Inc. and the National Futures Association.

FOR INSTITUTIONAL USE ONLY - NOT FOR USE AND/OR DISTRIBUTION TO RETAIL AND THE GENERAL PUBLIC.

This material is for informational purposes only. It is not an offer or solicitation to buy or sell any securities.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO. Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant. This material is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client's account should or would be handled, as appropriate investment strategies depend upon the client's investment objectives.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA): This marketing communication is disseminated by Goldman Sachs Asset Management B.V., including through its branches ("GSAM BV"). GSAM BV is authorised and regulated by the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten, Vijzelgracht 50, 1017 HS Amsterdam, The Netherlands) as an alternative investment fund manager ("AIFM") as well as a manager of undertakings for collective investment in transferable securities ("UCITS"). Under its licence as an AIFM, the Manager is authorized to provide the investment services of (i) reception and transmission of orders in financial instruments; (ii) portfolio management; and (iii) investment advice. Under its licence as a manager of UCITS, the Manager is authorized to provide the investment services of (i) portfolio management; and (ii) investment advice.

Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law.

To the extent it relates to custody activities, this financial promotion is disseminated by Goldman Sachs Bank Europe SE ("GSBE"), including through its authorised branches. GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank (Sonnemannstrasse 20, 60314 Frankfurt am Main, Germany) and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) (Graurheindorfer Straße 108, 53117 Bonn, Germany; website: www.bafin.de) and Deutsche Bundesbank (Hauptverwaltung Frankfurt, Taunusanlage 5, 60329 Frankfurt am Main, Germany).

Switzerland: For Qualified Investor use only - Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Bank AG, Zürich. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Bank AG, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Asia excluding Japan: Please note that neither Goldman Sachs Asset Management (Hong Kong) Limited ("GSAMHK") or Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H ) ("GSAMS") nor any other entities involved in the Goldman Sachs Asset Management business that provide this material and information maintain any licenses, authorizations or registrations in Asia (other than Japan), except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore, India and China. This material has been issued for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited and in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H).

Australia: This material is distributed by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (‘GSAMA’) and is intended for viewing only by wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth). This document may not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced or distributed to any person without the prior consent of GSAMA. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth). Any advice provided in this document is provided by either of the following entities. They are exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences, and are regulated under their respective laws applicable to their jurisdictions, which differ from Australian laws. Any financial services given to any person by these entities by distributing this document in Australia are provided to such persons pursuant to the respective ASIC Class Orders and ASIC Instrument mentioned below.

- Goldman Sachs Asset Management, LP (GSAMLP), Goldman Sachs & Co. LLC (GSCo), pursuant ASIC Class Order 03/1100; regulated by the US Securities and Exchange Commission under US laws.

- Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), pursuant to ASIC Class Order 03/1099; regulated by the Financial Conduct Authority; GSI is also authorized by the Prudential Regulation Authority, and both entities are under UK laws.

- Goldman Sachs Asset Management (Singapore) Pte. Ltd. (GSAMS), pursuant to ASIC Class Order 03/1102; regulated by the Monetary Authority of Singapore under Singaporean laws

- Goldman Sachs Asset Management (Hong Kong) Limited (GSAMHK), pursuant to ASIC Class Order 03/1103 and Goldman Sachs (Asia) LLC (GSALLC), pursuant to ASIC Instrument 04/0250; regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws

No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

FOR DISTRIBUTION ONLY TO FINANCIAL INSTITUTIONS, FINANCIAL SERVICES LICENSEES AND THEIR ADVISERS. NOT FOR VIEWING BY RETAIL CLIENTS OR MEMBERS OF THE GENERAL PUBLIC

Canada: This presentation has been communicated in Canada by GSAM LP, which is registered as a portfolio manager under securities legislation in all provinces of Canada and as a commodity trading manager under the commodity futures legislation of Ontario and as a derivatives adviser under the derivatives legislation of Quebec. GSAM LP is not registered to provide investment advisory or portfolio management services in respect of exchange-traded futures or options contracts in Manitoba and is not offering to provide such investment advisory or portfolio management services in Manitoba by delivery of this material.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law ("FIEL"). Also, any description regarding investment strategies on or funds as collective investment scheme under Article 2 paragraph (2) item 5 or item 6 of FIEL has been approved only for Qualified Institutional Investors defined in Article 10 of Cabinet Office Ordinance of Definitions under Article 2 of FIEL.

Interest Rate Benchmark Transition Risks: This transaction may require payments or calculations to be made by reference to a benchmark rate ("Benchmark"), which will likely soon stop being published and be replaced by an alternative rate, or will be subject to substantial reform. These changes could have unpredictable and material consequences to the value, price, cost and/or performance of this transaction in the future and create material economic mismatches if you are using this transaction for hedging or similar purposes. Goldman Sachs may also have rights to exercise discretion to determine a replacement rate for the Benchmark for this transaction, including any price or other adjustments to account for differences between the replacement rate and the Benchmark, and the replacement rate and any adjustments we select may be inconsistent with, or contrary to, your interests or positions. Other material risks related to Benchmark reform can be found at https://www.gs.com/interest-rate-benchmark-transition-notice. Goldman Sachs cannot provide any assurances as to the materialization, consequences, or likely costs or expenses associated with any of the changes or risks arising from Benchmark reform, though they may be material. You are encouraged to seek independent legal, financial, tax, accounting, regulatory, or other appropriate advice on how changes to the Benchmark could impact this transaction.

Confidentiality: No part of this material may, without GSAM's prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

GSAM Services Private Limited (formerly Goldman Sachs Asset Management (India) Private Limited) acts as the Investment Advisor, providing non-binding non-discretionary investment advice to dedicated offshore mandates, involving Indian and overseas securities, managed by GSAM entities based outside India. Members of the India team do not participate in the investment decision making process.