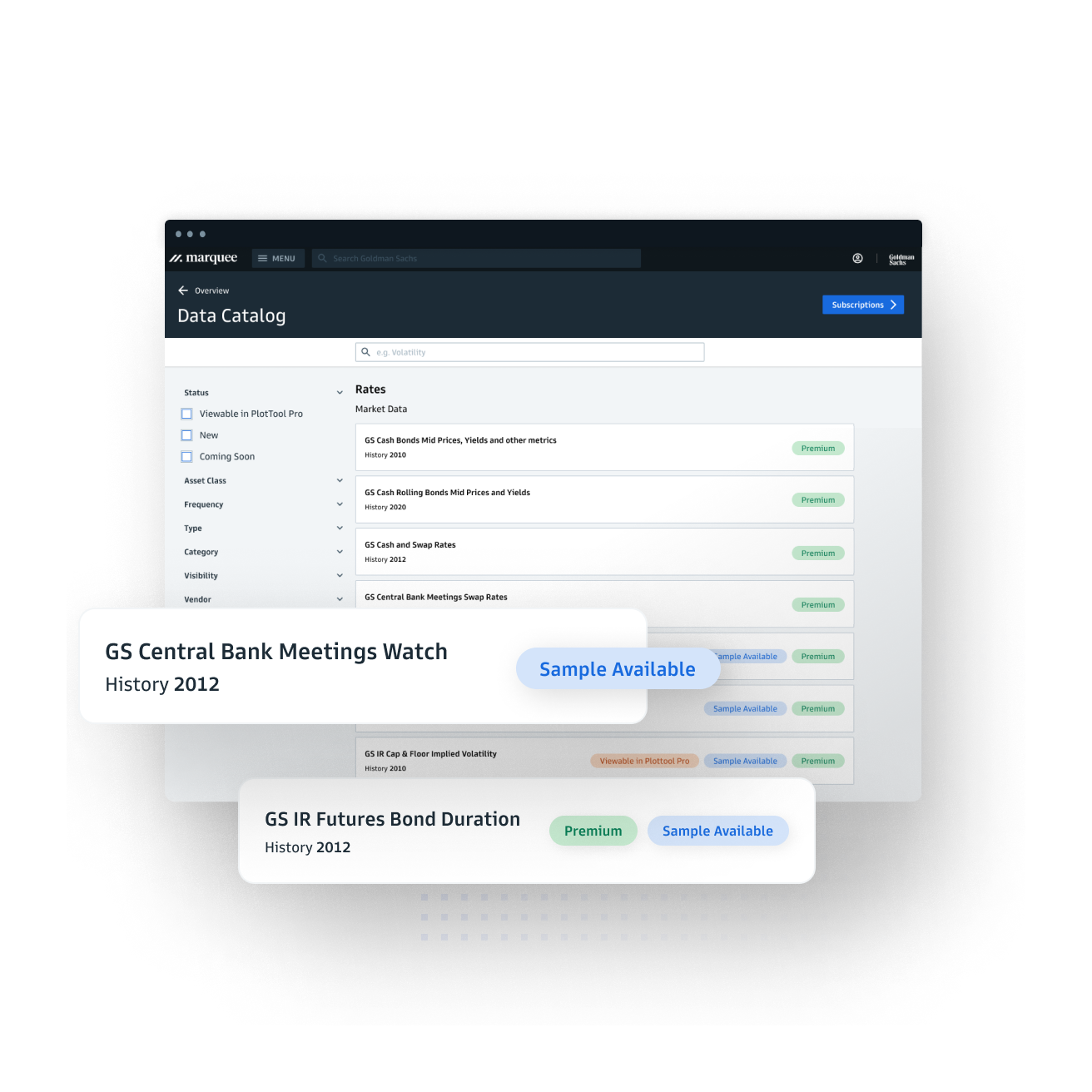

Third-party data: managed access to institutional-grade financial markets content

Streamline data sourcing and get access to select GS-curated third party data through Goldman Sachs. Third-party data is monitored and passes automated quality checks to quickly identify and correct issues.

Unique data products

Intraday and end-of-day data across asset classes, developed markets, and emerging markets—constructed with precision and granularity and based on the same models and data that our sales and trading desks leverage.

Extensive coverage

Bi-temporal data on thousands of securities, indices, and other financial products, all mapped onto a consistent identifier. Over thirty years of history for select assets, available in a standardized form.

Scalable access

Data connectivity in many integrated developer environments and coding languages. Retrieve data with speed and simplicity using documented APIs, which scale to meet your investment needs.

Access Data Through

PlotTool Pro

Analyze data using a rich library of mathematical functions and create custom data visualizations.

GS Quant

Accelerate development of quantitative strategies and manage risk with our open-source Python toolkit.

Find which solutions are right for your business

Contact our team to make sure our services meet your unique needs.

Solutions

Curated Data Security MasterData AnalyticsPlotTool ProPortfolio AnalyticsGS QuantTransaction BankingGS DAP®GS DAP® is owned and operated by Goldman Sachs. This site is for informational purposes only and does not constitute an offer to provide, or the solicitation of an offer to provide access to or use of GS DAP®. Any subsequent commitment by Goldman Sachs to provide access to and / or use of GS DAP® would be subject to various conditions, including, amongst others, (i) satisfactory determination and legal review of the structure of any potential product or activity, (ii) receipt of all internal and external approvals (including potentially regulatory approvals); (iii) execution of any relevant documentation in a form satisfactory to Goldman Sachs; and (iv) completion of any relevant system / technology / platform build or adaptation required or desired to support the structure of any potential product or activity. All GS DAP® features may not be available in certain jurisdictions. Not all features of GS DAP® will apply to all use cases. Use of terms (e.g., "account") on GS DAP® are for convenience only and does not imply any regulatory or legal status by such term.

¹ Real-time data can be impacted by planned system maintenance, connectivity or availability issues stemming from related third-party service providers, or other intermittent or unplanned technology issues.

Transaction Banking services are offered by Goldman Sachs Bank USA (“GS Bank”) and its affiliates. GS Bank is a New York State chartered bank, a member of the Federal Reserve System and a Member FDIC. For additional information, please see Bank Regulatory Information.

Certain solutions and Institutional Services described herein are provided via our Marquee platform. The Marquee platform is for institutional and professional clients only. This site is for informational purposes only and does not constitute an offer to provide the Marquee platform services described, nor an offer to sell, or the solicitation of an offer to buy, any security. Some of the services and products described herein may not be available in certain jurisdictions or to certain types of clients. Please contact your Goldman Sachs sales representative with any questions. Any data or market information presented on the site is solely for illustrative purposes. There is no representation that any transaction can or could have been effected on such terms or at such prices. Please see https://www.goldmansachs.com/disclaimer/sec-div-disclaimers-for-electronic-comms.html for additional information.

Mosaic is a service mark of Goldman Sachs & Co. LLC. This service is made available in the United States by Goldman Sachs & Co. LLC and outside of the United States by Goldman Sachs International, or its local affiliates in accordance with applicable law and regulations. Goldman Sachs International and Goldman Sachs & Co. LLC are the distributors of the Goldman Sachs Funds. Depending upon the jurisdiction in which you are located, transactions in non-Goldman Sachs money market funds are affected by either Goldman Sachs & Co. LLC, a member of FINRA, SIPC and NYSE, or Goldman Sachs International. For additional information contact your Goldman Sachs representative. Goldman Sachs & Co. LLC, Goldman Sachs International, Goldman Sachs Liquidity Solutions, Goldman Sachs Asset Management, L.P., and the Goldman Sachs funds available through Goldman Sachs Liquidity Solutions and other affiliated entities, are under the common control of the Goldman Sachs Group, Inc.

© 2025 Goldman Sachs. All rights reserved.