Data

Financial Series

This tutorial provides an overview of how to interact with financial data series. We'll walk through some examples of how to retrieve and visualize market data in order to analyze the performance of different assets. In this tutorial we will examine the prices of equity baskets, which provide investors with exposure to different market themes through custom baskets of stocks.

Retrieving Prices

First, let's get the prices of the Goldman Sachs Hedge Fund VIP Basket (Ticker: GSTHHVIP). This is a custom basket created by the Goldman Sachs Investment Research (GIR) group to track stocks which are widely held by the hedge fund community in the US, based on 13-F filings.

Note

Examples require an initialized GsSession and data subscription. Please refer to Sessions for details

We'll use the GS Custom Basket Prices dataset,

which contains prices for a selection of GS thematic equity baskets. This dataset contains the

closePrice field, which tracks the official closing price for each asset on a daily basis, and is

exposed in GS Quant as Fields.CLOSE_PRICE:

from gs_quant.data import Dataset, Fields

from datetime import date

basket_ds = Dataset('GSCB_FLAGSHIP')

start_date = date(2007,1,1)

vip_px = basket_ds.get_data_series(Fields.CLOSE_PRICE, start=start_date, ticker='GSTHHVIP')

vip_px.tail()Output:

Out[1]:

2019-06-14 269.314751

2019-06-17 271.106028

2019-06-18 274.046304

2019-06-19 276.174911

2019-06-20 279.399869

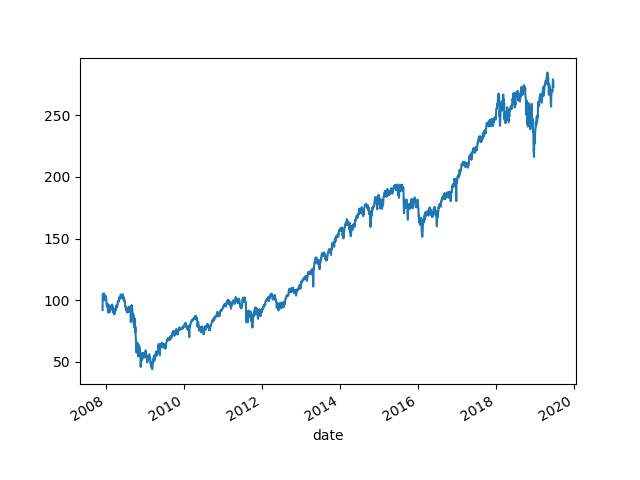

dtype: float64The first observation in the series is on 28th November 2007, and prices are available up to the most recent US market close. Let's plot the series to see how the basket has performed over the last 10+ years:

vip_px.plot()Output:

Comparing Performance

In addition to the Hedge Fund VIP Basket, the Portfolio Strategies Group within Goldman Sachs Investment Research also computes a basket of stocks which are most widely shorted across the hedge fund community. This basket is called the HF Important Shorts Basket (ticker: GSTHVISP). We'll retrieve the price history for this basket:

visp_px = basket_ds.get_data_series(Fields.CLOSE_PRICE, start=start_date, ticker='GSTHVISP')

visp_px.tail()Output:

Out[3]:

2019-06-14 231.022088

2019-06-17 230.661374

2019-06-18 232.949564

2019-06-19 233.424179

2019-06-20 235.450614

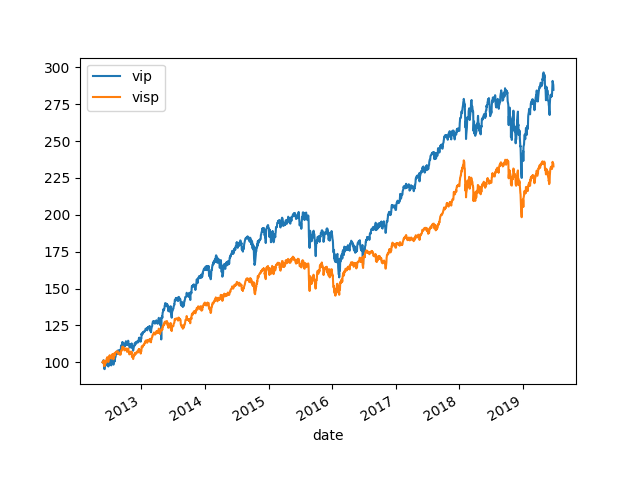

dtype: float64Now let's compare the prices of the two assets. First, we'll align the two series so that they cover the same date range, then index both series to 100 on the initial date and plot:

import gs_quant.timeseries as ts

import pandas as pd

[vip, visp] = ts.align(vip_px, visp_px, ts.Interpolate.INTERSECT)

vip = ts.index( vip, 100 )

visp = ts.index( visp, 100 )

compare = pd.DataFrame({'vip': vip, 'visp': visp})

compare.plot()Output:

Looks like the VIP basket has outperformed, the VISP basket over the last 5 or so years. Next we'll analyze performance over a few key statistical dimensions.

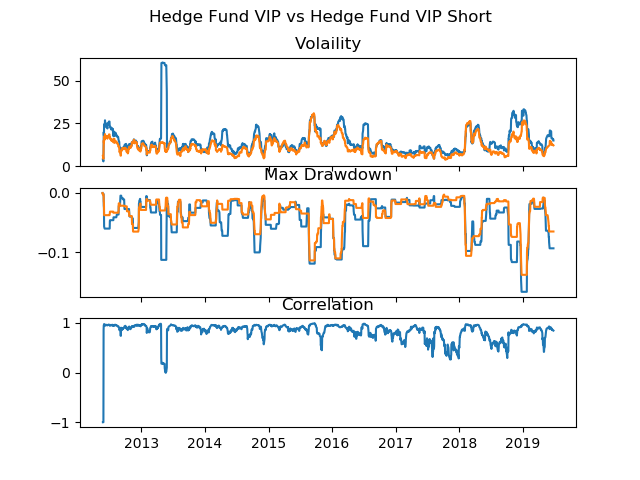

Analyzing Series

There are a few basic properties of a financial series we would look at in order to evaluate how it would fit into a portfolio. We'll run a quick analysis of our two series to evaluate them against these dimensions. Here's a quick summary of what we are going to compute:

| Measure | Description |

|---|---|

| Annual Volatility | Historical annualized realized volatility |

| Max Drawdown | Maximum peak-to-trough percentage drawdown over a given period |

| Correlation | Degree of linear relationship between the two assets |

Use the GS Quant timeseries functions to calculate, and then plot results:

import gs_quant.timeseries as ts

import matplotlib.pyplot as plt

window = 22 # 1 month (22 business day) lookback

vols = pd.DataFrame({'vip': ts.volatility(vip, window), 'visp': ts.volatility(visp, window)})

draws = pd.DataFrame({'vip': ts.max_drawdown(vip, window), 'visp': ts.max_drawdown(visp, window)})

corr = ts.correlation(vip, visp, window )

plot, axs = plt.subplots(3, sharex=True)

plot.suptitle('Hedge Fund VIP vs Hedge Fund VIP Short')

axs[0].title.set_text('Volaility')

axs[1].title.set_text('Max Drawdown')

axs[2].title.set_text('Correlation')

axs[0].plot(vols)

axs[1].plot(draws)

axs[2].plot(corr)Output:

A few quick takeaways, which were probably intuitive from the original price curves:

- The hedge fund short basket generally has lower volatility than the long basket

- The long basket has larger maximum drawdown than the short basket

- The correlation between the products is generally close to 1

Related Content

Querying Data

arrow_forwardWas this page useful?

Give feedback to help us improve developer.gs.com and serve you better.