Portfolios allow for efficient pricing and risk. The same principles in the in the basic risk and pricing tutorials can be applied to portfolios. Pricing and risks can be viewed for an individual instrument or at the aggregate portfolio level

info

Note

Examples require an initialized GsSession and relevant entitlements. Please refer to Sessions for details.

from gs_quant.session import Environment, GsSession

from gs_quant.common import PayReceive

from gs_quant.instrument import IRSwaption

import gs_quant.risk as risk

import datetime as dtswaption1 = IRSwaption(PayReceive.Receive, '5y', 'EUR',

expiration_date='3m', name='EUR3m5y')

swaption2 = IRSwaption(PayReceive.Receive, '5y', 'EUR',

expiration_date='6m', name='EUR6m5y')# Create Portfolio w/ swaptions

from gs_quant.markets.portfolio import Portfolio

portfolio = Portfolio((swaption1, swaption2))

portfolio.resolve()# Calculate Risk for Portfolio

port_risk = portfolio.calc(

(risk.DollarPrice, risk.IRDeltaParallel, risk.IRVega))# View Instrument Level risk for portfolio

port_risk[risk.IRDeltaParallel]['EUR3m5y']Output:

date 2020-02-13 -293.405359 dtype: float64

# View Aggregated Risk for a Portfolio

port_risk[risk.IRDeltaParallel].aggregate()Output:

date 2020-02-13 -590.072113 dtype: float64

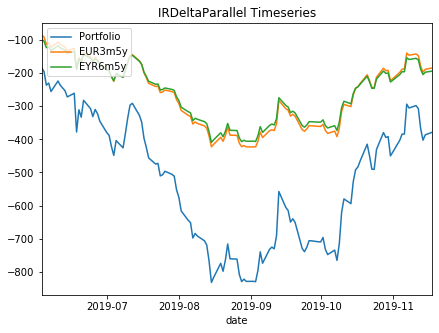

# Calculate Portfolio Risks within HistoricalPricingContext

from gs_quant.markets import HistoricalPricingContext

start_date = dt.date(2019, 6, 3)

end_date = dt.date(2019, 11, 18)

with HistoricalPricingContext(start_date, end_date):

port_ird_res = portfolio.calc(risk.IRDeltaParallelLocalCcy)port_ird_agg = port_ird_res[risk.IRDeltaParallelLocalCcy].aggregate()

swap1_ird = port_ird_res[risk.IRDeltaParallelLocalCcy]['EUR3m5y']

swap2_ird = port_ird_res[risk.IRDeltaParallelLocalCcy]['EUR6m5y']import matplotlib.pyplot as plt

plt.figure(figsize=(7, 5))

plt.xlabel('Date')

ax1 = port_ird_agg.plot(label='Portfolio')

swap1_ird.plot(label='EUR3m5y')

swap2_ird.plot(label='EYR6m5y')

h1, l1 = ax1.get_legend_handles_labels()

plt.title('IRDeltaParallel Timeseries')

plt.legend(h1, l1, loc=2)

plt.show()Output:

Related Content

Previous - Pricing Context

arrow_forwardNext - Scenarios

arrow_forwardWas this page useful?

Give feedback to help us improve developer.gs.com and serve you better.