Data

Charting Data

A simple way to chart data in GS Quant is by installing matplotlib. This plotting library can be

used to easily generate plots, histograms, power spectra, bar charts, error charts, scatter plots,

etc.

Let's use this library to chart calculated implied volatility from GS Quant.

Note

Examples require an initialized GsSession and data subscription. Please refer to Sessions for details.

Querying Data

First, let's retrieve S&P 500 end of day implied volatility for 1 month tenor with forward strike:

from gs_quant.data import Dataset

from gs_quant.markets import PricingContext

market_date = PricingContext.current.market.date # Determine current market date

vol_dataset = Dataset(Dataset.GS.EDRVOL_PERCENT_STANDARD) # Initialize the equity implied volatility dataset

vol_data = vol_dataset.get_data(market_date, market_date, ticker='SPX', tenor='1m', strikeReference='forward')

print(vol_data.tail())Output:

absoluteStrike assetId ... ticker updateTime

21 4049.365704 MA4B66MW5E27U8P32SB ... SPX 2019-06-17T22:18:01Z

22 4193.985908 MA4B66MW5E27U8P32SB ... SPX 2019-06-17T22:18:01Z

23 4338.606111 MA4B66MW5E27U8P32SB ... SPX 2019-06-17T22:18:01Z

24 5061.707130 MA4B66MW5E27U8P32SB ... SPX 2019-06-17T22:18:01Z

25 5784.808149 MA4B66MW5E27U8P32SB ... SPX 2019-06-17T22:18:01Z

[5 rows x 9 columns]Charting Data

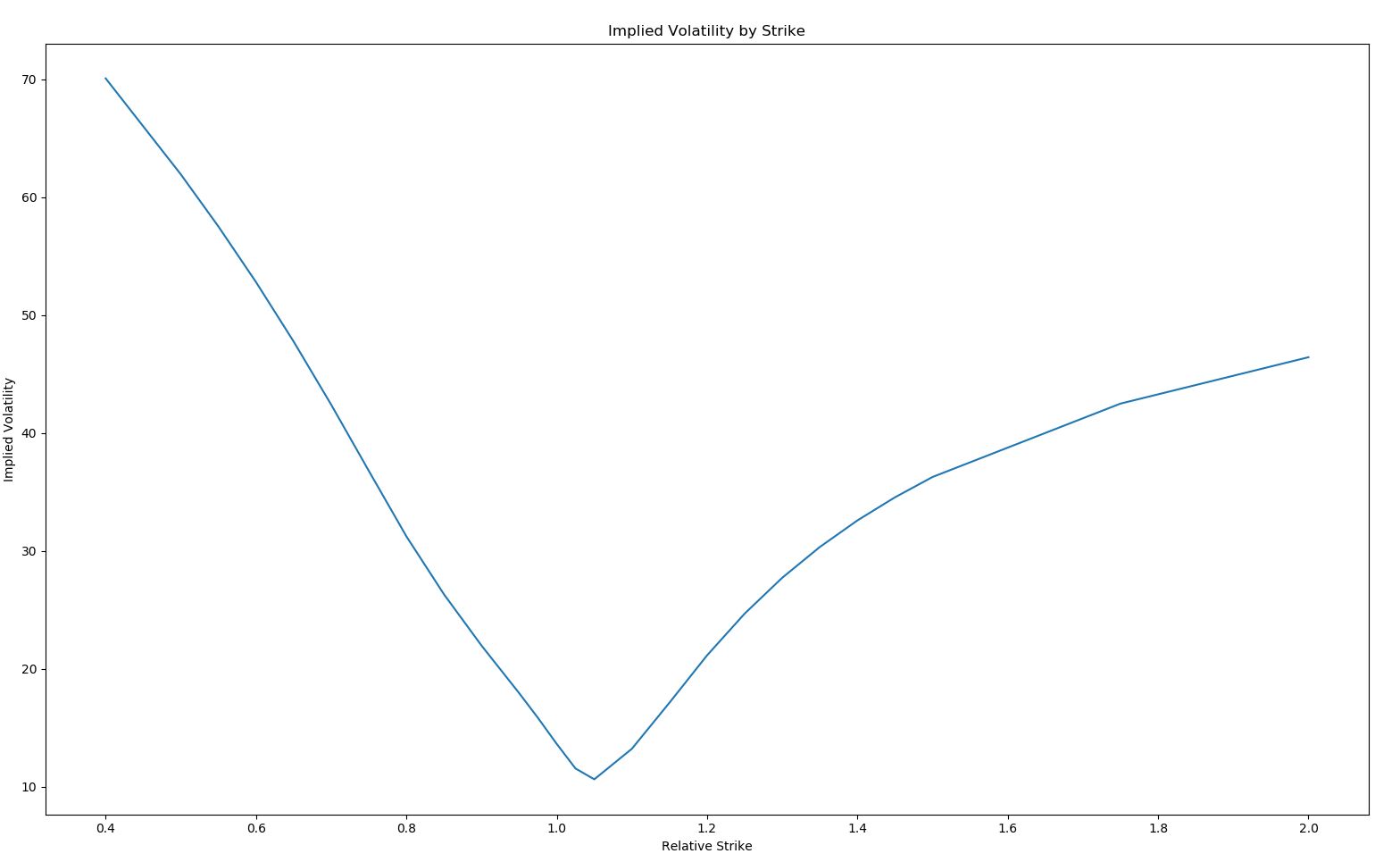

Implied Volatility By Strike

Now, let's use vol_data to chart the implied volatility by relative strike:

Note

Remember to install matplotlib.

add the following import statement to have matplot available:

import matplotlib.pyplot as pltthen plot your data like so:

strikes = vol_data['relativeStrike']

vols = vol_data['impliedVolatility'] * 100

plt.plot(strikes, vols, label='Implied Volatility by Strike')

plt.xlabel('Relative Strike')

plt.ylabel('Implied Volatility')

plt.title('Implied Volatility by Strike')

plt.show()Which will create a plot like this:

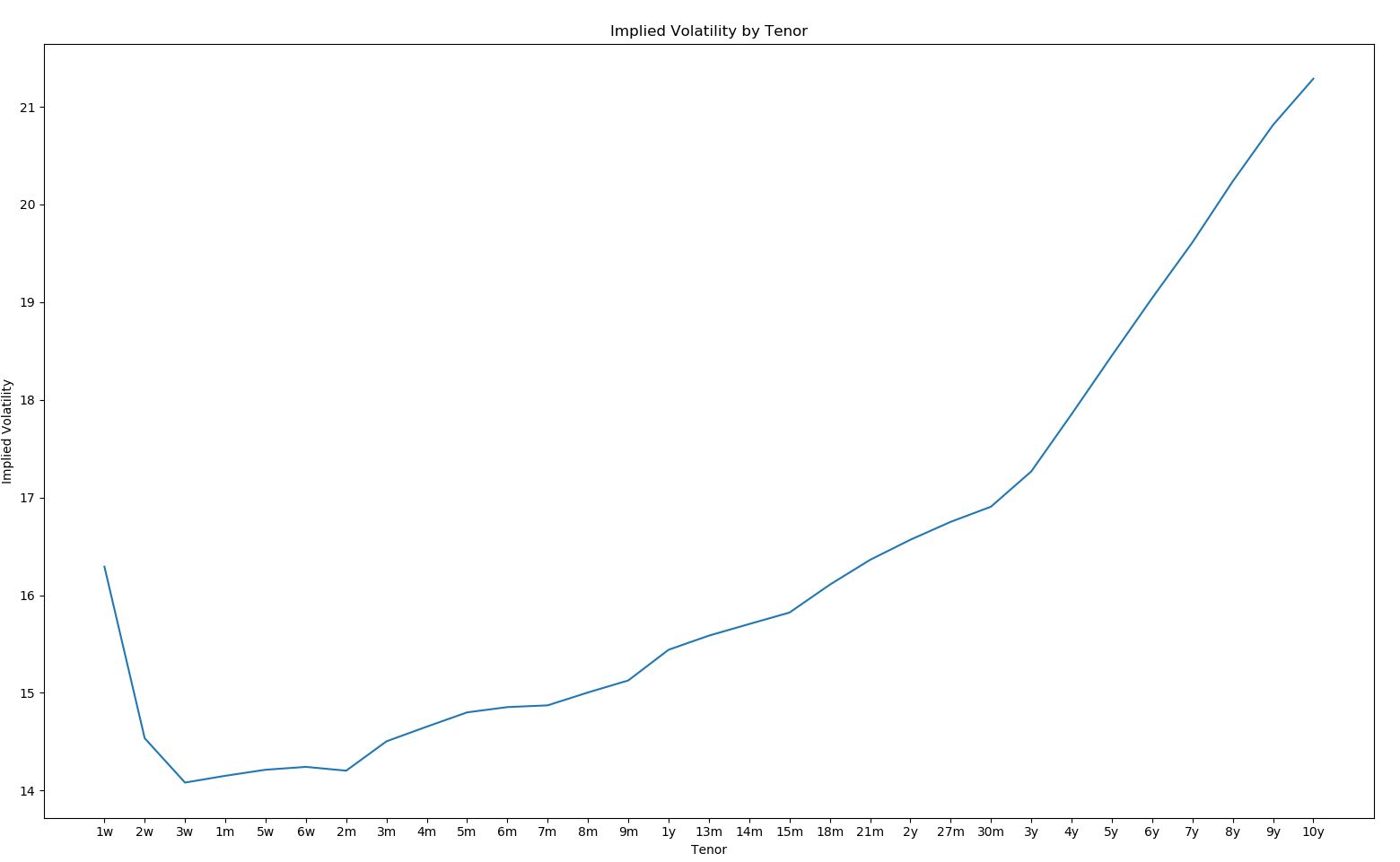

Implied Volatility By Tenor

Likewise we can use the same technique to chart the implied volatility by tenor:

from gs_quant.timeseries.measures import _to_offset

vol_data = vol_dataset.get_data(market_date, market_date, ticker='SPX', relativeStrike=1.0, strikeReference='forward')

# Create a new column converting relative dates to actual date times

vol_data.loc[:, 'tenorDate'] = vol_data.index + vol_data['tenor'].map(_to_offset)

# Sort the data frame by the newly created column

vol_data = vol_data.sort_values(by=['tenorDate'])

tenors = vol_data['tenor']

vols = vol_data['impliedVolatility'] * 100

plt.plot(tenors, vols, label='Implied Volatility by Tenor')

plt.xlabel('Tenor')

plt.ylabel('Implied Volatility')

plt.title('Implied Volatility by Tenor')

plt.show()Producing:

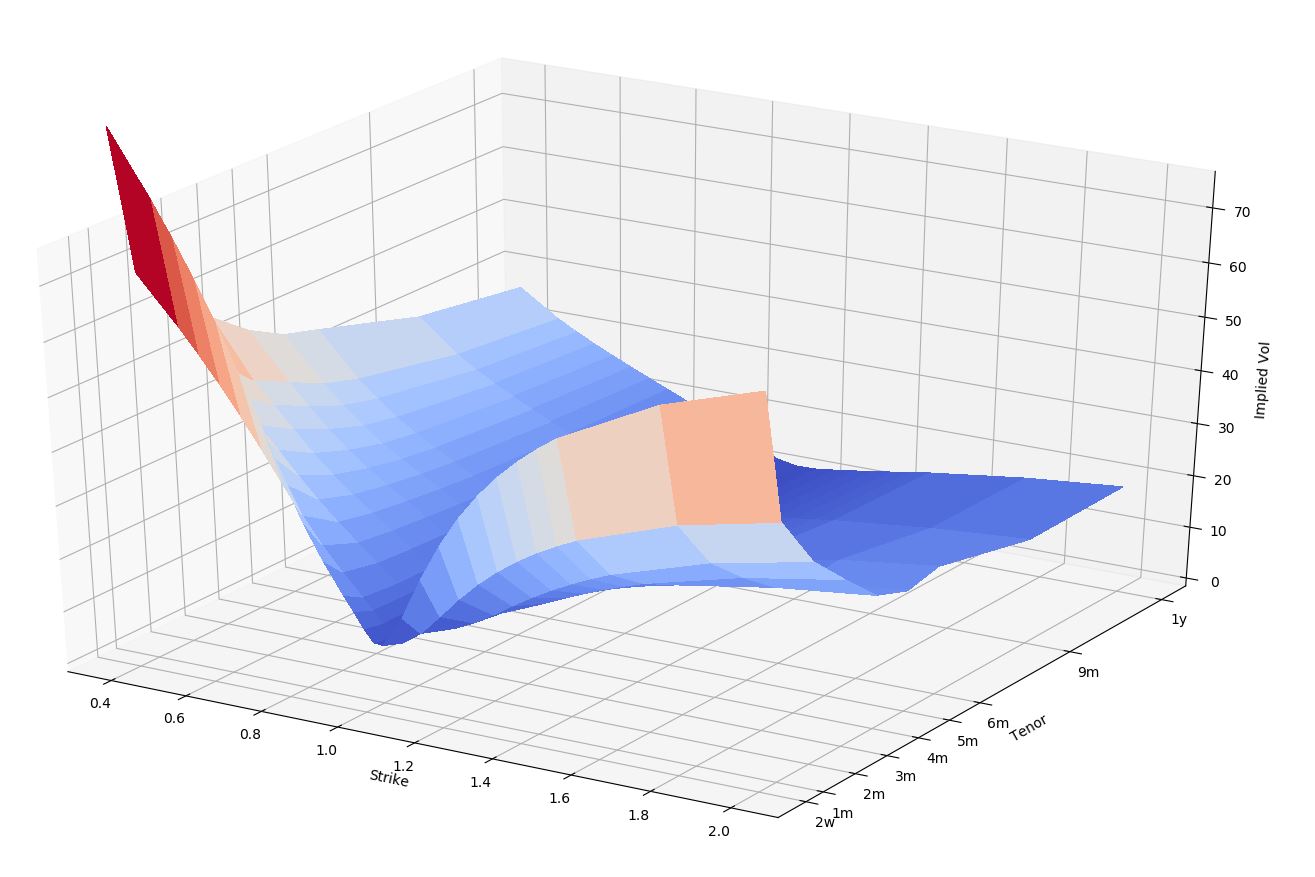

Implied Volatility Area By Tenor And Strike

Now, let's combine the two and plot a vol surface to chart the implied volatility by tenor and strike:

import matplotlib.pyplot as plt

import numpy as np

from matplotlib import cm

from gs_quant.data import Dataset

from gs_quant.datetime import point_sort_order

from gs_quant.markets import PricingContext

# Initialize the dataset for equity implied volatility

vol_dataset = Dataset(Dataset.GS.EDRVOL_PERCENT_STANDARD)

market_date = PricingContext.current.market.date

tenors_to_plot = ["2w", "1m", "2m", "3m", "4m", "5m", "6m", "9m", "1y"]

fig = plt.figure(figsize=(16, 9))

ax = fig.add_subplot(111, projection='3d')

# Implied vol data for the current market data date

vol_data = vol_dataset.get_data(market_date, market_date, ticker='SPX', strikeReference='forward')

vol_data = vol_data[vol_data.tenor.isin(tenors_to_plot)]

vol_data['tenorDays'] = vol_data.tenor.map(lambda t: point_sort_order(t))

# Reformat the data

X = vol_data.relativeStrike.unique()

Y = vol_data.tenorDays.unique()

Z = np.array([vol_data[vol_data.tenorDays == y].impliedVolatility.values.tolist() for y in Y]) * 100

X, Y = np.meshgrid(X, Y)

# Plot the surface

ax.xaxis.set_label_text("Strike")

ax.yaxis.set_label_text("Tenor")

ax.zaxis.set_label_text("Implied Vol")

ax.set_zlim(0, 75)

ax.set_yticks(vol_data.tenorDays.unique())

ax.set_yticklabels(vol_data.tenor.unique())

surface = ax.plot_surface(X, Y, Z, cmap=cm.coolwarm, linewidth=0, antialiased=False)

plt.show()The previous example should produce a 3D graph similar to this:

Related Content

Exporting Data

arrow_forwardWas this page useful?

Give feedback to help us improve developer.gs.com and serve you better.